BLOG

Why Cash Flow Should be Your Primary Business Accelerant

5 min. read

Jun 16, 2021

When Guidant Financial and the Small Business Trend Alliance surveyed businesses at the end of last year, they found that 78% of them expected to survive. But do you want your business simply to survive this year or do you want to kick it up a notch, make up for a year lost to the pandemic, and accelerate your growth as the economy picks up speed?

If you’re ready to grow, one of the most important things you can do is to better manage your cash flow. A US Bank study found that 82% of small businesses fail due to cash flow problems. While many business owners leave cash flow to their accounting team, it’s so vital to your success that, no matter how brilliant your team is, you should stay on top of it.

Here are three ways to improve your cash flow and jump start the next level of business growth.

Expand your payment options—and use them strategically

Ninety percent of the world’s business is still done in cash, but you don’t have to let that rule your cash flow. There are times when you gain an advantage by paying in cash. In certain situations, paying in cash can create stronger negotiations where there is wiggle room. Some businesses will even give you an early-pay discount for paying in cash. And there are no hidden fees when you use the money you have in the bank to directly pay a vendor.

But because it comes immediately from your bank account paying in cash can also be a bottleneck to your growth. Your money might be already tied up with a vendor when you’re invited to participate in a huge selling event. Or you might be in a business where you have to pay for materials six or eight months before you can sell the product.

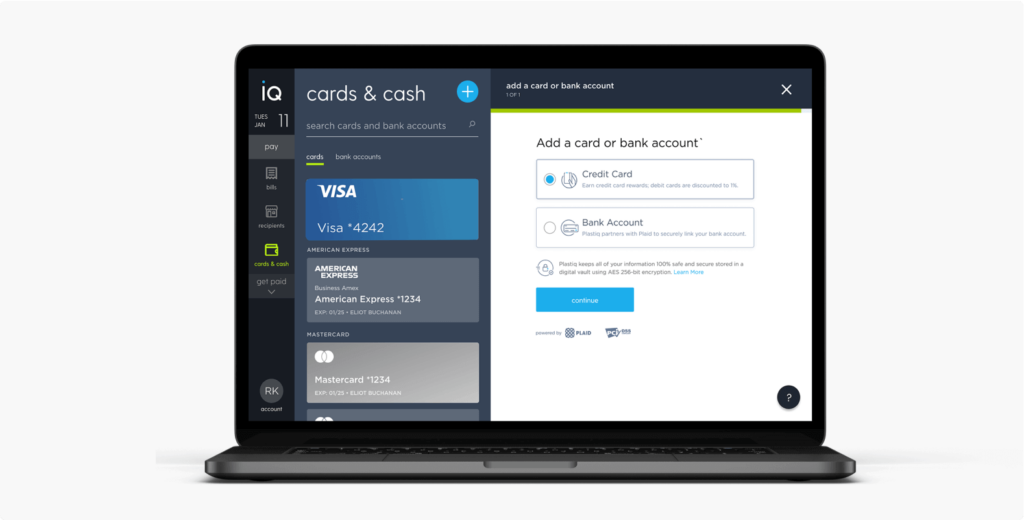

Using a business credit card can create float time of 30-50 days or longer when you need it to stretch cash flow. You can also take advantage of cash back and reward programs that reduce the spend or give you extra advantages. The challenge is that most manufacturers, your landlord, your taxing authority, and other vendors tell you that you can’t pay by credit card. They want cash, a wire transfer or an ACH.

A new breed of services let you use your credit card to pay bills in a way that’s transparent to the vendor. You use your credit card and gain the float and the rewards, and the service pays your vendor in the way they want to receive their money. Often, these services sync your credit card payments directly to your accounting software and some will do the same with cash payments. They smooth your growth by extending your cash flow to cover surprises and opportunities without a hitch.

Improve your reporting

David Worrell, Founder and CFO of Fuse Financial Partners recommends making your reports reliable, readable, and regular. This is particularly true when it comes to reporting on cash flow.

Automatically syncing your payment details with your accounting software not only ensures you have the cash flow information you need, it also eliminates human input errors so you know the data is clean.

Take the time to make sure your reporting reflects what you need to see. Even an out-of-the-box cash flow report will show you details of the money you’ve brought in and what you’re spending. But is the report easy to understand? How hard is it to figure out your working capital? If you can’t tell quickly what your cash position is, it’s time to ask your financial team to adjust the report or hire a hands-on consultant who can quickly update the reporting input and template for you.

Knowing this helps you plan for next week and next month, as well as the long-term, even when that means accounting for the unexpected. A credit card helps you flex, but how comfortably will you be able to pay it off in the 50 days it gains you? Do you have the resources to take advantage of a pop-up opportunity, if one came along? When your advertising opens a previously untapped market, can you fully serve those customers, or should you pass until you can do it right?

Cash is the lifeblood of your business and as a business owner, you need to keep your finger firmly on its pulse.

Cut your expenses—wisely

One way to expand the money available to your business is to spend less, with caution, because spending too little can throttle your growth. So, when I talk about cutting expenses, I mean getting the most out of every dollar you’re spending.

For example, advertising and marketing typically account for a large portion of the budget, but they’re also how you attract new customers and grow revenue. You don’t want to cut them out, but you do want to look at their results and make sure you’re marketing to the right audiences and making your programs as effective as possible.

Raymon Ray, Founder of Smart Hustle Media, is an advocate of automation, and so am I. As with syncing expenses with your accounting software, automation effectively handles repetitive tasks and reduces human error for things that don’t require human expertise or creativity. Some examples are marketing automation which eliminates manual outreach and responses, sales process automation which reduces manual entry and lets you process a higher volume of leads, and financial automation for invoicing and scheduling payments. Automating these tasks allows you to get more done with the staff you have, and it frees them to focus their high-value skills to move your business forward more quickly.

Make it a growth year

A Statista survey in the fourth quarter of 2020 found that about 65% of small business owners felt their cash flow would be good or very good during the next 12 months. Follow these three tips and you’ll not only ensure that your cash flow is “very good,” you’ll boost your growth and lay the foundation for continued acceleration over time.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.