BLOG

What is Friendly Fraud and How Does Plastiq Help Protect Your Business?

7 min. read

Jun 10, 2022

By: Tal Yeshanov – Director, Risk and Strategic Financial Operations

By: Tal Yeshanov – Director, Risk and Strategic Financial Operations

Spurred by the impact of the COVID-19 pandemic, there has been a steep 14.2% shift to e-commerce in 2021, with digital payments also on the rise—and here to stay. Further, the global digital payments market is expected to grow 19.4% annually between 2021 and 2028.

When it comes to payment methods, results of one McKinsey study showed consumers currently use two or more digital payments methods like credit cards to make purchases, jumping from 45% in 2019 to 58% in 2020 alone. Despite this anticipated growth, not all businesses are ready to make this shift to accepting credit cards fully. Why? I think some are still choosing not to accept credit cards due to concerns about chargeback disputes, particularly ‘friendly fraud’ chargebacks.

These chargeback disputes have exploded over the past ten years, growing exponentially—and while some chargebacks are legitimate, friendly fraud chargebacks are not.

What is Friendly Fraud Chargeback?

This type of chargeback occurs when cardholders falsely dispute a charge by claiming they did not receive the goods or services when they actually did. Friendly fraud chargebacks are concerning for many businesses because the business ends up taking the financial loss.

Let me offer a real-world example: When a cardholder orders an item online, the business ships it, and the cardholder receives it—but then the cardholder contacts their bank and (falsely) claims they didn’t get the item or there was an issue with it.

The Impact of First-Party Misuse Fraud Chargebacks

Friendly fraud chargebacks have officially become the leading fraud trend affecting the payment industry today. Named after the war term ‘friendly fire,’ it describes weapons fire that comes from one’s own side and is not actually friendly at all, often causing accidental injury or death to one’s own forces. Friendly fraud is so prevalent, and anything but ‘friendly’, that the industry has renamed it “first-party misuse fraud.” I believe this name change signifies a more accurate representation of the abuse, and shows the payment industry’s acknowledgement and commitment to fighting it. In its Global Fraud Survey Results 2021 report, the Merchant Risk Council (MRC) lists friendly fraud as one of the top fraud attack types around the globe.

Top Fraud Attacks

Why Fight Friendly Fraud Chargebacks?

Now the top fraud trend—Friendly Fraud (aka First Party Misuse fraud) chargebacks were up by 9% in 2021 compared to 2020. In fact, friendly fraud has moved from the No.5 to No.1 spot in ecommerce sales—impacting 92% of merchants.

As you can see ‘friendly fraud’ is the top attack type in Medium-sized Businesses (SMBs), mid market, and enterprises.

Most might also be surprised to know that “as fraud attempts and fraud rates by revenue have risen, fraud management costs have increased fivefold, on average, compared to pre-COVID, from an average of 2% of annual eCommerce revenue in 2019 to around 10% this year”—making this challenge alarming and one that must be adequately and expediently addressed.

If your business chooses to forego fighting chargebacks, the cardholders get away with friendly fraud—making it easier for cardholders to repeat this harmful practice, and essentially causing you, the business, to be out the funds. Worse yet, it falsely leads the bank to believe the cardholder’s claims are true. Multiple chargebacks can damage your reputation with banks whenever future disputes arise.

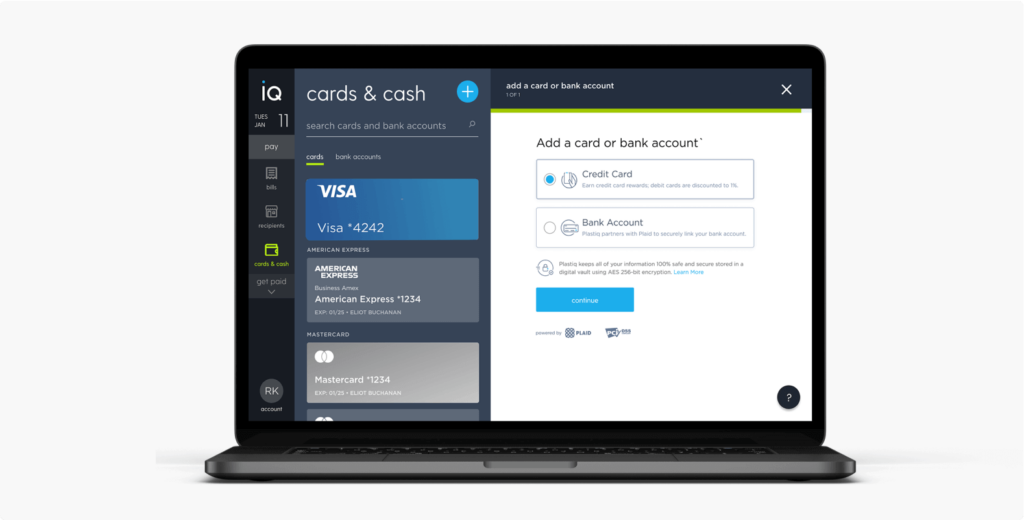

How to Prevent Friendly Fraud with Plastiq

Currently, there are over ten different chargeback mitigation providers offering mitigation and representment services —which speaks to how rampant of an issue chargebacks are. Businesses who use Plastiq’s product offering will not be in need of the aforementioned providers, because Plastiq has built-in solutions to help businesses address chargebacks.

Plastiq has built custom anti-risk solutions and employs dedicated Analysts to combat multiple types of fraud and abuse. Plastiq has made a strategic business decision to build solutions that help keep our users – you the business – safe from both financial and reputational harm. “At a strategic level, manual order review continues to play a pivotal role in fraud management approaches, as evidenced by the 36% of overall eCommerce fraud management spending for review-related costs, globally.

This is relatively consistent with 2019, where 42% of spending was earmarked for review-related costs, globally.” Plastiq leverages manual reviews and innovative technology to help your business reduce fraud loss.

We act as the ‘Merchant of Record’ on behalf of your business. We handle false chargeback claims so that your business has peace of mind. How? Plastiq takes on representing the chargeback to enable your business to focus on better things—running your operations!

Without Plastiq, it can be difficult for your in-house staff to keep pace with the card network and bank chargeback policies. Banks require the ‘Merchant of Record’ to respond to the chargeback, but suppose your business cannot keep up with the process changes, or requirements to submit proof that services or goods were provided, in that case, some banks will automatically side with the cardholder who falsely claimed a chargeback, and your business would be out the money, along with chargeback penalties and fees.

What’s Plastiq’s Value Add?

Ecommerce payments have been growing at a steady rate every year. Ecommerce growth infrastructure is relatively still in its infancy, but thanks to Plastiq’s advanced technological innovations, Plastiq has been helping businesses shift decades old ‘in-store’ payments towards moving to use credit cards online. People can pay online, and the goods or services are then delivered to them.

People are enjoying the benefits of ecommerce ‘Card Not Present’ online transactions, however, as those transactions grow in volume, so does the First Party Misuse fraud. With FPM fraud, a cardholder falsely files a chargeback with their issuing bank stating that they didn’t receive their goods or services when they did in fact receive it. When this sort of chargeback behavior occurs, we help your business dispute the chargeback. Here’s more about what we do to help businesses fight these false claims through the chargeback representment process.

Chargeback Representment

Representment is one of the most critical aspects of the chargeback process for businesses. On behalf of your business Plastiq acts as the ‘Merchant of Record’ and creates a package of material proving abuse occurred. The package would include a rebuttal letter outlining our case against the cardholder and ‘compelling evidence’ as support. All of the documentation is then forwarded to the cardholder’s issuing bank. Compelling evidence can be any of the following:

Address Verification System (AVS) and Card Verification Value (CVV)

This is a transaction record confirming that the Address Verification System (AVS) and Card Verification Value (CVV) collected matches the cardholder’s payment credentials. But these alone may not always be sufficient to win against false claims that the card was used without proper authorization. Information from other anti-fraud and identity verification tools are used to increase the chances of winning.

Terms & conditions, and refund, documentation

We provide a copy of the terms and conditions of the sale and highlight relevant proof that the cardholder agreed to abide by the terms. We also provide information about the refund policy, if and when relevant.

Communications between your business and the cardholder

Any copies of communications between your business and the cardholder could be relevant if they show that your business was making a good faith effort to resolve a cardholder’s concerns or issues. Plastiq will work with your business to collect all necessary information, and submit on your behalf.

Receipts or invoices

Copies of receipts or invoices should be submitted. Especially, if they contain special requests or instructions from the cardholder that relate to the chargeback reason—these are particularly useful.

The cardholder’s order history

If it exists, the cardholder’s past order history can show that the cardholder previously had no issue with similar or identical purchases. As the ‘Merchant of Record’, Plastiq has documentation such as invoices, IP logs, internal data, or other documentation that demonstrates the cardholder made use of our platform. We prove that the cardholder didn’t dispute previously and show that they accepted these charges in the past, without issues.

In the end, if the cardholder’s issuing bank believes the evidence is sufficient, they’ll reverse the chargeback and the business will not be out the funds. If the evidence is insufficient, the issuing bank can reject evidence and uphold the chargeback. Successfully fighting friendly fraud chargebacks rests on the experience and assistance from companies like Plastiq to handle chargeback representation. We combat FPM fraud with state-of-the-art technology and effective operations and policies. We’re experienced at knowing how to fight false chargeback claims.

With Plastiq as a top payments solution provider, many companies now know we handle business-to-business (B2B) payments. They’re asking about Plastiq and want to work with us! The businesses that use Plastiq have come to trust us because we do our utmost to protect them. Find out more about how we can help protect your business from friendly fraud.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.