Payments

Deep Dive:

for Accountants

The shape of payments in the accounting industry today.

The global accounting services industry is ranked as the 4th largest industry by market size. In the US alone, a combination of in-house accountants and over 660,000 licensed CPAs help businesses handle back-office operations. Accountants play a pivotal role in helping businesses with back-office tasks, including accepting and processing payments on behalf of clients. But clients' needs are changing—they want accountants to deliver greater strategic value to increase their competitive advantage. To do this, accountants must improve their operational agility—and having the right business tools is key. Plastiq Pay helps accountants automate payment workflows and provides the flexibility and reliability needed to ensure they can deliver greater strategic value to clients.

Key Payments Challenges

Accounting firms are facing some common challenges.

Outdated legacy

systems

Accountants must replace outdated siloed systems with innovative cloud-based payment platforms designed for mobility in mind.

Numerous manual

processes

Back-office processes need to be streamlined and simplified to free up valuable time for higher-level strategic work.

Attachment to the

status quo

Reimagining how work gets done and automating manual data entry is needed for faster and more reliable results.

Plastiq Pay Solutions

Plastiq Pay meets those challenges.

Effortless payment

processing

Plastiq Pay is flexible and offers more payment options with a built-in approval process to process payments for clients.

AI-powered invoice

data import

Plastiq Pay quickly and seamlessly imports data to increase accuracy, without worrying about incorrect payment details.

Automatic two-way

data syncing

Plastiq Pay syncs bills, suppliers, and payments to QuickBooks Online, Xero, Oracle Netsuite, and Sage Intacct.

Plastiq Accept solves payment problems before they're problems.

Automated approvals

Automated approvals

Streamlined payment process

Streamlined payment process

Pay suppliers faster

Pay suppliers faster

Extend cash on hand

Extend cash on hand

Easy international payments

Easy international payments

Cash flow monitoring

Cash flow monitoring

Tax-deductible fees

Tax-deductible fees

Greater expenses visibility

Greater expenses visibility

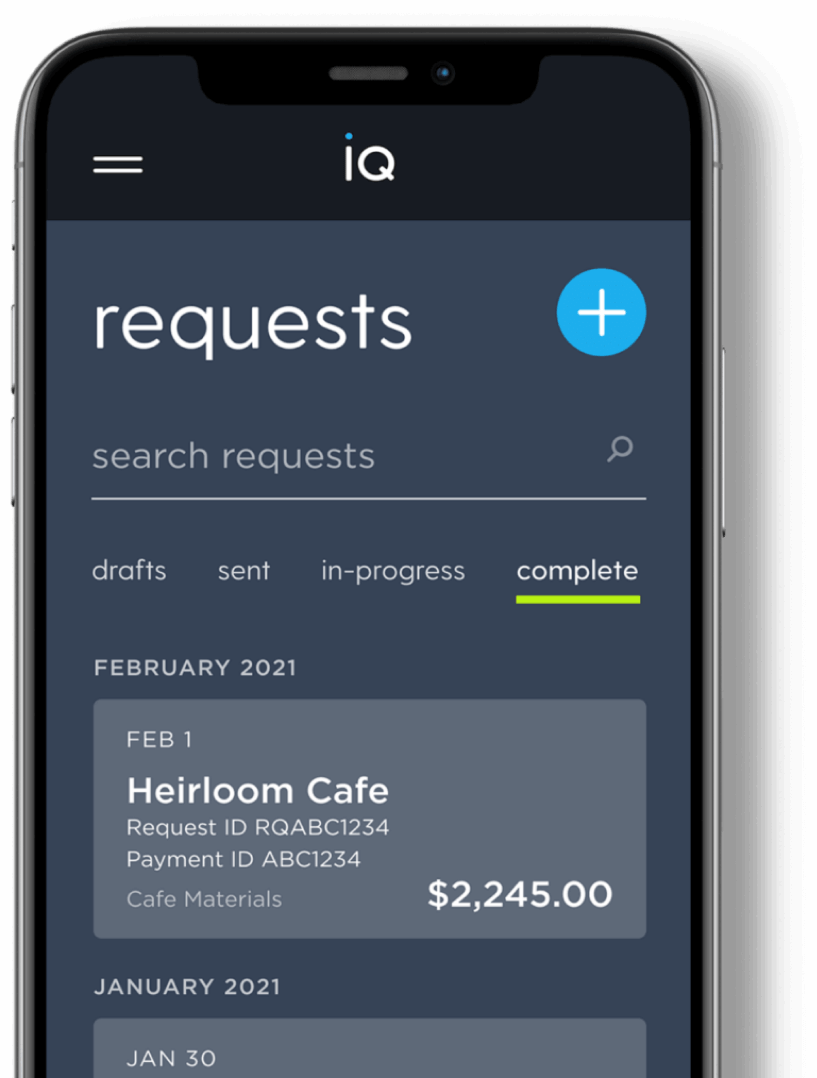

Plastiq Accept - Don’t chase, automate.

Effectively supporting business clients means accountants need to offer better ways to collect receivables. The way forward is through mobile-enabled digital payment platforms that provide increased flexibility and predictability. This ensures improved business growth and sustainability for clients working remotely. Plastiq Accept removes payment collection gaps by seamlessly integrating faster payment collection, thus improving cash flow.

Think Plastiq Pay is right for your business?

Reach out for more information or to request a demo.

Need more info? Let's talk.