Payments

Deep Dive:Retail and Ecommerce

The shape of payments in retail and ecommerce today.

The COVID-19 pandemic supercharged ecommerce growth in the US to $430 Billion in 2020, with projected growth of 31% to $561 billion by 2025. Additional factors driving growth include increased digital adoption by consumers and technology investments by brands in omnichannel and headless commerce. Amazon, Walmart, and eBay dominate with over 50% of market share combined, followed by Apple, Best Buy, and Target, each capturing less than 5% of share. Opportunities for smaller brands with unique products and purpose are grabbing attention of Amazon-weary consumers.

Key Payment Challenges

Retailers are facing some common challenges.

Inventory

management

Maintaining positive cash flow while making large investments upfront in inventory that may not sell until next season.

Complex payment

process

Retailers must find ways to pay a variety of domestic and overseas suppliers and have transparency on payment status.

Global

procurement costs

Slow payment processes, hidden costs and a lack of transparency on payment delivery add stress to supplier relationships.

Plastiq Pay Solutions

Plastiq Pay meets the challenges.

Inventory & cash

flow visibility

Use Plastiq Pay to quickly secure inventory while keeping an eye on your total cash flow position.

Streamlined

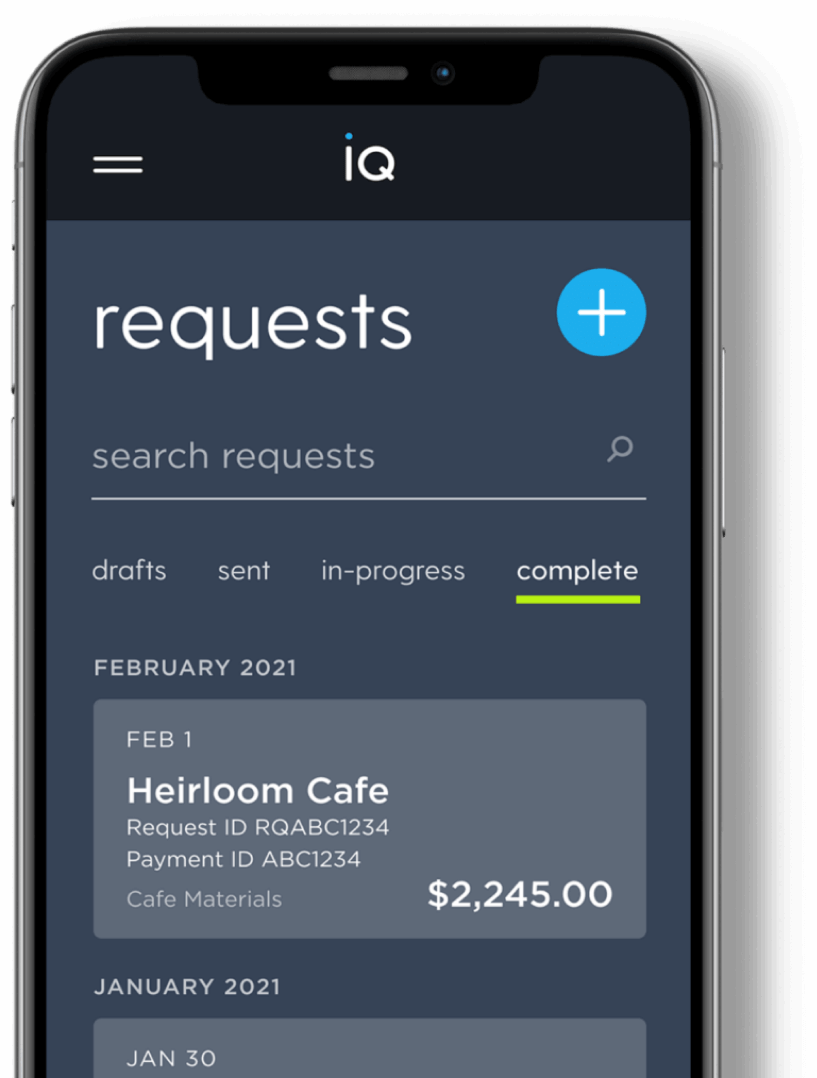

payment collection

Plastiq Pay is a single point of payment for all your suppliers.

Global payment

management

Plastiq Pay works in more than 45 countries in 22 currencies.

Use Plastiq Pay and get more from your payments.

Automated approvals

Automated approvals

Pay suppliers faster

Streamlined payment process

Pay suppliers faster

Pay suppliers faster

Extend cash on hand

Extend cash on hand

Easy international payments

Easy international payments

Cash flow monitoring

Cash flow monitoring

Tax-deductible fees

Tax-deductible fees

Greater expenses visibility

Greater expenses visibility

Evolve the way you pay with Plastiq Pay.

As a retail business, you need ongoing advertising to reach new customers and keep existing customers coming back. You also need to purchase inventory from overseas suppliers well ahead of the season those goods will sell. Plastiq helps you preserve cash on hand so that you can extend the time to pay off your higher expenses closer to the time when the merchandise will sell. Pay suppliers and vendors in the U.S. or in more than 45 countries in 22 unique local currencies across the globe faster and more efficiently with Plastiq.

Universal Standard grows their brand with Plastiq Pay.

The challenge: Digital advertising is a major ongoing cost. Facebook’s credit card terms required daily payments.

The Plastiq Pay solution: Universal Standard leverages Plastiq to pay advertising and inventory expenses to preserve cash on hand. “We’ve really used Plastiq to extend the runway on certain payments. We time our payment cycle so that advertising expenses in January don’t need to be paid until April.” -Jason Rappaport, Chief of Staff and General Counsel.

Think Plastiq Pay is right for your business?

Reach out for more information or to request a demo.

Need more info? Let's talk.