BLOG

Plastiq For Your Small Business

2 min. read

Jun 27, 2019

Plastiq is a modern payments company designed to unlock access to your existing credit, so you can pay vendors, suppliers, and other business expenses. Even ones that don’t normally accept credit cards. Tens of thousands of small businesses trust Plastiq with billions in payments to increase their cash flow and gain greater financial flexibility so they can seize new opportunities. Our customers tell us that they use Plastiq to improve their business by:

Increasing Inventory on Hand: Hasan Hasmani of Underdog Games says Plastiq has allowed him to grow his inventory by 25%.

Cash Flow: Premier Boutique uses Plastiq as a way to float their cash because their business is seasonal. The company tells us that Plastiq allows them to better manage my cash flow, as we have high seasonal inventory.

Card Rewards: Premier Boutique also prefers using Plastiq because “we can earn more card rewards on payments I otherwise wouldn’t be able to put on my credit card.”

Convenience: Lost Dog Caf√© owner, Mike Barnes, says as a restaurant owner, we see millions in payments between our four locations. Since most of our vendors do not accept cards, I can use Plastiq for things like recurring supplies… I even automate my payments using Plastiq’s scheduling feature.

The inventory buying power, in particular, is an impactful aspect of using Plastiq. For example, a small business needs to purchase inventory but doesn’t want to spend all their cash upfront. With Plastiq, small businesses can pay with their credit card, gain up to 60 days of cash float, and increase their working capital. Simply put, Plastiq allows small businesses to maximize their cash on hand because it enables companies to put expenses on a credit card now and pay by the statement due date up to 60 days later.

How Plastiq Helps Small Businesses Succeed

With Plastiq, there is no need for small businesses to take out lines of credit or loans with hefty interest rates. We take away the application waiting period, the costly interest rates, and reduce the stress that comes with managing cash flow by allowing you to use your existing credit in order to grow your business faster.

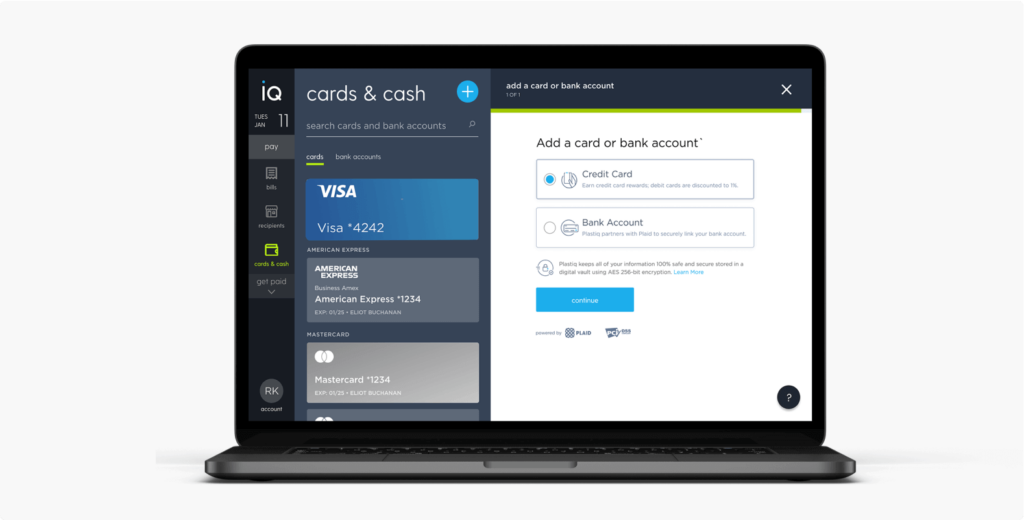

Getting Started

Plastiq can help your business better utilize existing credit in a few simple steps. You tell us who the recipient is and how much you want to pay them, Plastiq charges your card plus our simple *2.9% fee, then the recipient receives your payment in the form of a check, ACH, or wire transfer.

Whatever your small business goals are, think of Plastiq as a partner that can help you reach those goals. It’s easy to get started with Plastiq. Sign up for your free account today!

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.