BLOG

Learn How Credit Cards Can Accelerate Cash Flow

1 min. read

Jul 1, 2019

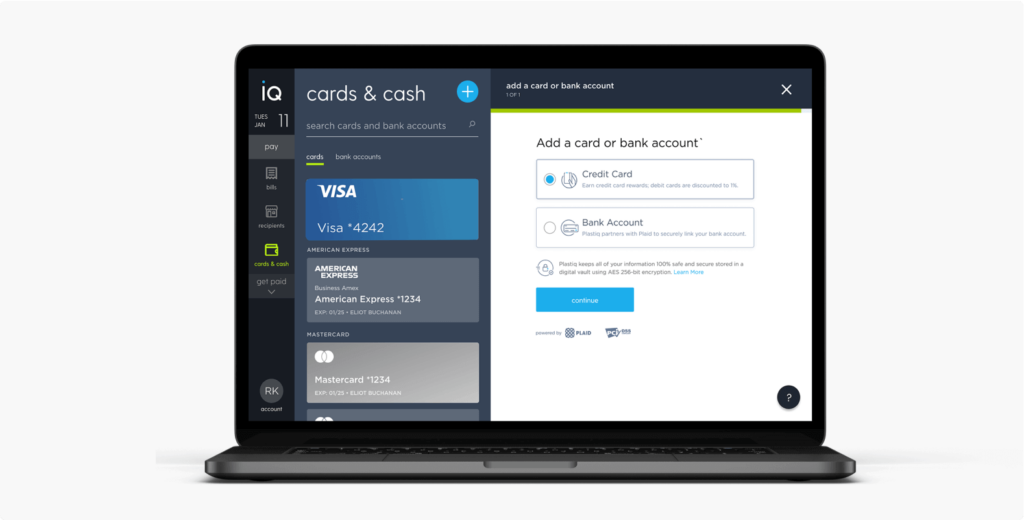

Ever wondered how you can increase your cash flow? Using Plastiq’s new benefit calculator we can show you how your business can increase cash flow in order to go after new opportunities.

Here’s how the calculator works.

1. Enter the amount of money to pay your vendor for your expenses.

Keep in mind that with Plastiq, you can pay virtually any vendor, even if they don’t accept cards. The recipient doesn’t even need to be signed up to use Plastiq.

2. Enter the percentage of the early payment discount.

It’s common that vendors offer early payment discounts, usually around 3%. Through Plastiq, your company can negotiate terms to reap the benefits of the Plastiq.

3. Enter the credit card cash back reward.

Many credit card companies reward cash back on purchases. Through Plastiq, you can pay expenses with a credit card and earn even more rewards (typically 1-3% in cash back or points). In fact, the rewards are often times even greater. There have been past cases where Plastiq users used their credit cards to pay off their Tesla and earned huge cash rewards.

4. Enter the tax deduction benefit.

We find that many businesses are able to write off part of the Plastiq fee as a business expense. See our blog post for more information.

5. Plastiq will calculate the approximate fee, assuming all the benefits and discounts are applied.

Using the benefits calculator, you’ll be able to approximate your effective Plastiq fee, factoring in the potential benefits and discounts.

Estimating The Number of Days of Float:

1. Enter the date you need to pay your vendor.

In order to pay your vendors quickly, we provide three payment options: a check, wire transfer, or ACH bank transfer.

2. Enter the credit card statement close date and the credit card payment due date.

This information is found on your monthly statement.

3. Plastiq will calculate the approximate days of cash float.

You can gain up to 60 days of float which can help your small business expand by enabling you to have more cash on hand. Some of our customers have gained up to 105 days of cash float by negotiating longer payment terms. See how

Summary

With the Plastiq advantage, you have the freedom to pay virtually any vendor with your credit card, all while seizing new opportunities and enjoying rewards that can help your business grow. Check out our benefits here and see how Plastiq can be the fuel for your cash flow.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.