San Francisco, CA -

Plastiq and Billfire partner to enable businesses to offer more payment options to their customers

Press Releases

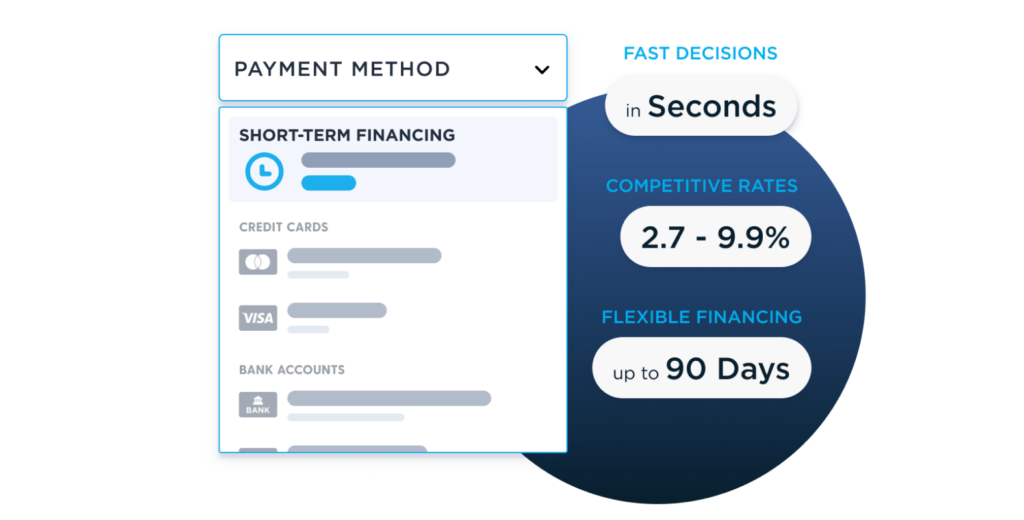

Plastiq, the payment platform that enables businesses to better manage payments and cash flow, and Billfire, a leading provider of intelligent A/R automation solutions that streamline the invoice-to-cash process, partner to help suppliers and distributors get paid faster and more flexibly by allowing them to accept payments via credit card without any merchant fees. This new integration between the two companies delivers an improved, seamless experience for Billfire customers.

“The way businesses conduct financial transactions is heavily antiquated,” said Sameer Gulati, President and COO at Plastiq. “It’s time for a change, and that’s what we’ve made happen with our suite of products from Plastiq. We aim to take the guesswork out of payments for our customers, and adding Billfire to our growing list of partners means that we’re able to reach a larger group of businesses who are in need of low-cost, easy-to-use payments and better cash flow management.”

The capability to accept payment via credit card without paying a merchant fee expands electronic payment capabilities to a wider group of vendors and industries. It can also provide additional working capital to the buyers, while accelerating receivables and increasing margins for the suppliers.

“At Billfire, we seek to bring the benefits of automation in payments to our customers by helping them get paid faster, reduce risk, and eliminate time-consuming tasks,” said John Lockhart, Billfire CEO. “Partnering up with Plastiq means we’ll be able to broaden credit card acceptance for our customers, and allow them to avoid unwanted merchant fees. We are thrilled to announce this integration with Plastiq.”

Plastiq enables businesses to pay or get paid by credit card, even when cards aren’t accepted, so they can increase working capital, scale rapidly, and be more agile. Plastiq has already powered billions in payments for 1.5 million individuals and businesses. Billfire’s flagship product, VALET, helps suppliers and distributors get paid faster by streamlining the entire invoice-to-cash process. Together, Billfire and Plastiq will help businesses more swiftly and efficiently manage their accounts receivable.

To learn more about Plastiq’s partnership with Billfire, visit www.plastiq.com or www.billfire.com.

About Plastiq

Plastiq is a smart payment platform designed for businesses to better manage their payments and cash flow. The platform lets companies maximize their existing credit, pay in whatever way is best for their business—regardless of what payment methods their recipients accept—and get paid by card without the burden of card acceptance fees. Businesses can pay globally in more than 40 countries, and it works with all major credit card providers, including Mastercard, Visa, American Express, and Discover. Plastiq has

more than 1.5 million clients and has processed billions in payments for a wide range of expenses, from business supplier payments and contractors to taxes and rent. Plastiq has won a number of awards and recognitions, including being named to the 2020 Forbes FinTech 50. Learn more at www.plastiq.com.

About BillfireBillfire is a leading provider of easy-to-implement, intelligent A/R automation solutions that streamline the entire invoice-to-cash process. The company’s flagship product – the VALET suite – helps suppliers and distributors get paid faster by making it easier for their customers to receive, review, and pay invoices – anytime, from anywhere. VALET’s robust feature set, combined with Billfire’s unwavering commitment to customer success, empowers suppliers and distributors to take a more proactive approach to A/R, so they can accelerate cash flow, increase productivity, and minimize risk. Headquartered in Scottsdale, Arizona, Billfire employs a team of dedicated professionals with extensive experience in technology and B2B payments. Today, more than 450,000 active users trust Billfire to process more than $20 billion in transactions each year. For more information, visit https://www.billfire.com.