San Francisco, CA -

Plastiq Launches Next Generation of “Plastiq Connect” at Money2020 to Enable Any Business to Offer Embedded Financial Services

Press Releases

Businesses can now natively embed supplier card and bank payment capabilities into any application

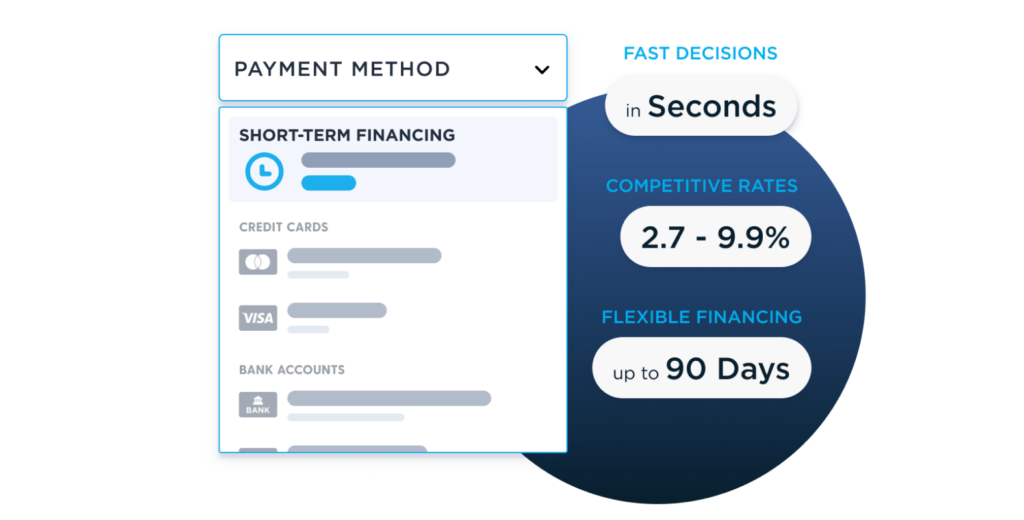

SAN FRANCISCO, Oct. 24, 2022 /PRNewswire/ — Plastiq, a B2B payments platform that offers bill pay and instant working capital access to businesses, today announced expanded integration options to its embedded finance product. Plastiq Connect provides platforms with a configurable way to enable multiple payment methods and disbursement options for their business customers to more easily pay suppliers and get paid by their customers. The new integration method offers an embeddable UI, similar to a white label experience, that requires even less development time.

“Embedded finance is not only changing the way businesses transact and maintain working capital, it’s giving any business the opportunity to offer financial services as a means to expand product lines and drive growth,” said Plastiq founder and CEO, Eliot Buchanan. “Businesses looking to get into the $9 trillion financial services market have two choices: they can spend millions to build or buy financial services technology, or they can partner with a proven platform like Plastiq Connect. With a single line of code, they can get to market in just weeks while outsourcing the operations functions of risk, KYC, and compliance to Plastiq.”

What makes Plastiq unique from Stripe and others?

The payments industry’s credit card acceptance model for the past five+ decades has focused on one primary construct: the merchant funded processing model.

Plastiq’s approach is the exact opposite, introducing the solution that both buyers and sellers have been demanding. We believe a more significant share of the $9 trillion B2B payments market can run on card rails, so we reversed the model. Our belief is that the ecosystem can support a buyer-funded model versus the supplier-funded model that is the status quo. Unleashing the power of underutilized existing working capital or new readily acceptable lines of credit and a digital bill pay/AP all businesses can grow and scale faster.

With Plastiq Connect, banks and platforms can:

- Enable invoice payments by card to any vendor around the globe even where cards are not accepted.

- Support a payer funded card payment model

- Expand or enter new payments categories to monetize customer payments without taking on the risk, operations or compliance functions

According to Adam Younger, Chief Revenue Officer at PayGround, “At PayGround our goal is to help medical patients pay any healthcare provider from a single dashboard. Plastiq Connect enabled us to seamlessly integrate our mobile app and payments capabilities. From day one, we received a ton of support from team Plastiq, helping with engagement and fueling the project.”

For more information about Plastiq Connect, visit booth 3010 at Money2020.

ABOUT PLASTIQ

Founded in 2012, Plastiq operates in the $9 trillion B2B payment market. We built the financial operating system for small businesses helping them improve cash flow with an all-in-one bill pay solution that offers instant access to working capital. Plastiq’s embedded finance solutions enable platforms to easily monetize their customer base by offering B2B payments, without the burden of managing the risk and operations. Plastiq raised more than $140 million in funding and is backed by Kleiner Perkins, B Capital Group, Khosla Ventures, and other top tier investors.