BLOG

Can You Pay Rent With a Credit Card?

4 min. read

Apr 19, 2018

It’s still possible, even if your landlord doesn’t take credit cards.

Paying your rent with a credit card every month is a convenient option for renters. When it comes to paying rent, most people don’t think about credit cards because generally, landlords don’t offer it as a payment option. But paying with a card has advantages over a check or cash: no more hassling with checks, superior cash flow management, and with some cards, you can get reward points on one of your biggest fixed costs.

How To: Paying Rent With a Credit Card

There are two main ways to pay rent with a credit card. You can either use your landlord’s payment system or pay via a third-party company.

If you deal with a large property management company, you may be able to use your credit card through their payment system. However, if the building is owned by a small business or an individual, chances are the company won’t have a payment system and you’ll have to pay with a check or cash.

If you’ve got a smaller landlord, you can still pay with a credit card via a third-party bill payment service. For instance, Plastiq allows any tenant to make payments to any landlord. Your landlord doesn’t even need a Plastiq account to accept the payment–Plastiq will deliver an electronic payment to your landlord or cut a check.

Pay Your Rent With Plastiq

If you’re ready to start paying your rent with a credit card, try Plastiq. It’s free to make an account and getting started is simple. Rent payments can be made with cards from all major issuers, including Visa, Mastercard, Discover, and American Express.

(Looking to pay your mortgage with a credit card instead of rent? We can help with that too: learn more here.) Make the switch to paying the rent with a credit card, and sign up for Plastiq today.

Paying Rent with Credit Card: Pros & Cons

Pro: Say Goodbye to Checks

Most landlords require rent payments by check or cash. As a renter, this can put you at a disadvantage. What if the paper check gets lost in transit? What if your rent is the only thing you pay for with checks? And if you choose to pay in cash, what if something happens to all that money?

You can eliminate all these analog hassles by paying your rent with a credit card, you eliminate the hassle of paying with analog methods.

Pro: Reward Yourself

Rent is one of the biggest monthly expenses people have, so reaping the rewards your credit card has for using it makes sense. Different cards give you rewards in different ways but the most common are, redeemable points, travel perks, or cashback bonuses. Choose the rewards that best fits your needs and rack up the points with your rent payments.

Pro: No More Waiting for Payday

Have you ever had to ask for a cash advance to be able to make your rent payment on time? Do you wish you could pay rent in the middle of the month, after you’ve already been paid? If so, then paying for your rent with a credit card may be a good option.

If you know you will be able to pay your credit card bill after payday, but can’t front the money on the first of the month, this likely sounds ideal. You don’t have to worry about coming up short for rent, and your landlord will always get your payment on time.

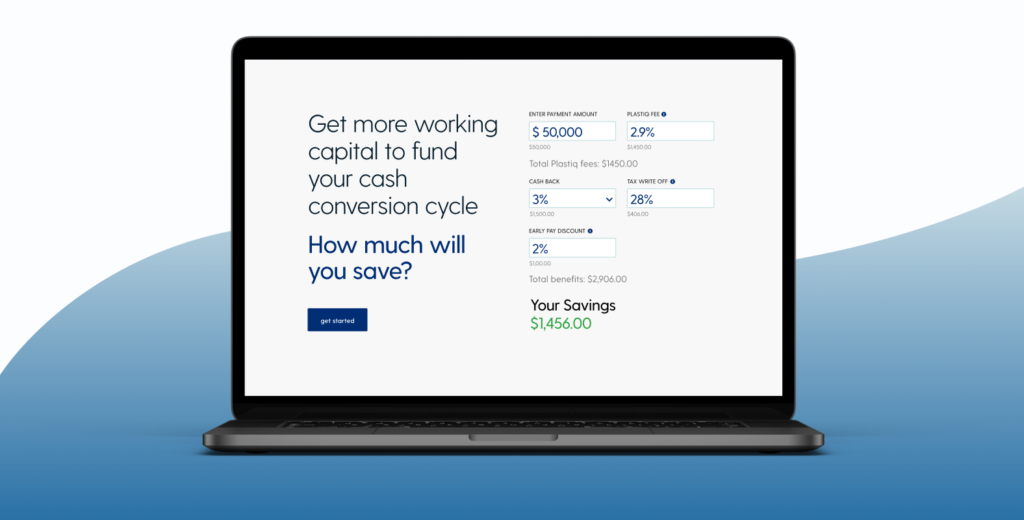

Con: Fees

When you do pay for rent with a credit card, there is usually a processing fee. This fee can oftentimes be offset by rewards offered by your credit card (points, cashback, etc.). Plastiq charges a 2.85% fee, one of the lowest on the market. Keep fees and card benefits in mind as you determine whether or not paying rent with a credit card is right for you.

Con: Credit Score Impact

Paying for rent with your credit card likely will increase your credit card utilization. This can impact your credit score, especially if you have a low credit limit. If you are able to keep your credit utilization ratio below 30% of your maximum while paying rent on your card, it should not substantially impact your credit score according to most major credit bureaus.

Con: Account Hassle

Some payment platforms require your landlord to make an account so you can pay them with a credit or debit card. With Plastiq, that’s not a problem — submit your payment with your credit card and we’ll send a check, ACH, or wire transfer to your landlord, and you can pay with a credit card.

Things to Consider

Before you pay rent with a credit card, here are some things to keep in mind.

Writing-Off Fees

If you’re making rent or lease payments for a business, you can write-off certain fees since the payments are considered a business expense.

Spending Habits

Do you pay off your entire balance or just make a minimum payment? If you’re in the habit of not paying your balance each month, paying rent with a credit card might not be a good idea. Carrying a balance every month can result in more interest and fees.

However, if you’re strategic, paying rent with a credit card is an ideal choice for earning rewards and keeping your finances on track. Also, knowing that your rent payment is automatically taken care of every month gives you one less thing to worry about.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.