BLOG

Can You Pay Your Mortgage With a Credit Card?

5 min. read

Apr 24, 2018

In terms of managing your budget, mortgage payments are generally the most costly bill of the month, often taking more than one third of pre-tax income. And because mortgage companies don’t allow for credit card payments, it can be difficult to offset this substantial bill. For some people, the ability to pay via credit card could make taking on a mortgage more manageable.

Plastiq makes paying your mortgage with a credit card a reality. But how does it really work? How can it benefit you… and what are the risks? Read on as we explain the process, perks, and potential perils of paying your mortgage via Plastiq.

Steps to Paying Mortgage with Credit Card

Paying mortgage with a credit card is easy when you know where to do this transaction. Plastiq provides the one way to pay mortgage with a credit card. The process is straightforward, easy and convenient. The mortgage can be paid on a one-time basis or every month and setting up credit card payments takes just minutes online.

Pros of paying your mortgage with a credit card

Plastiq is a third-party service which allows you to pay your mortgage via credit card, which lenders generally don’t allow. The benefit of this is that you’ll have more money on hand and be able to soften the heavy financial blow that mortgage payments often represent. Additionally, you’ll accumulate more interest by leaving cash in the bank, as well as greater credit card rewards & the ability to control when you pay.

Find out what other bills you can pay using Plastiq.

Hold on to your cash

By paying your mortgage lender with a credit card, you’ll reduce the impact mortgage payments typically have on your budget, allowing you more time to make the payments. This enables you to maintain more cash on hand for other financial obligations, or in the event of emergencies. You’ll also avoid costly late charges by guaranteeing your payment ahead of time, saving you even more money.

Generate interest

Not only will you keep more cash on hand as a result of using your credit card to pay your mortgage, but you’ll also keep more cash in the bank. This will lead to greater accumulation of interest, as your funds will remain in the bank for longer.

Rack up the rewards

Who doesn’t love a reward? With all the activity on your credit card from paying your mortgage, you’re bound to earn plenty of rewards from your provider such as gift cards, points, or cash back. You can maximize your bonuses even further by making other payments with your credit card as well.

Pay on your schedule

Financial freedom is yet another benefit of choosing to pay your mortgage with Plastiq. Instead of taking making an enormous payment all at once, you’ll now have the ability to control & stagger payments according to your schedule & financial needs, and pay your mortgage like you would any other credit card bill.

Cash advance alternative

The payment itself is registered with the credit card company as a purchase rather than a cash advance. This avoids the high interest rates that typically come with getting a cash advance and ensures your money stays where it belongs – in your pocket.

Cons of paying your mortgage with a credit card

While the benefits are substantial, there are a few potential drawbacks to consider when determining if paying your mortgage via credit card is right for you. Fees and interest could apply, depending on your card and making large payments may have an effect on your credit score as well.

Additional fees

Convenience fees are charges applied for the benefit of using a credit card as an alternative to another payment and vary anywhere between 1.3 – 3.5%. While this may not be as impactful for smaller transactions, it’s certainly something to consider for larger sums like mortgage payments.

Credit ratio impact

Depending on your personal credit limit, using a credit card to pay your mortgage may also increase you credit utilization ratio beyond the ideal threshold, which is usually about 15 – 30% of your credit limit. Be sure to keep this threshold in mind when deciding if using a credit card to pay your mortgage is the right fit for you.

Credit score decrease

Because of the significant charge usually associated with a mortgage payment, it’s even more critical that credit card payments be made on time. A single late payment as a result of paying your mortgage via credit card can drastically decrease you credit score. However, if you maintain scheduled payments, you can avoid this pitfall altogether.

Can I pay my mortgage with American Express?

You may want to pay mortgage with American Express. Unfortunately, mortgage payments aren’t permitted with the card issuer at this time. Keep in mind that American Express can still be used for a variety of other payment types such as tuition or rent.

View the full list of applicable transaction types for American Express & other cardholders.

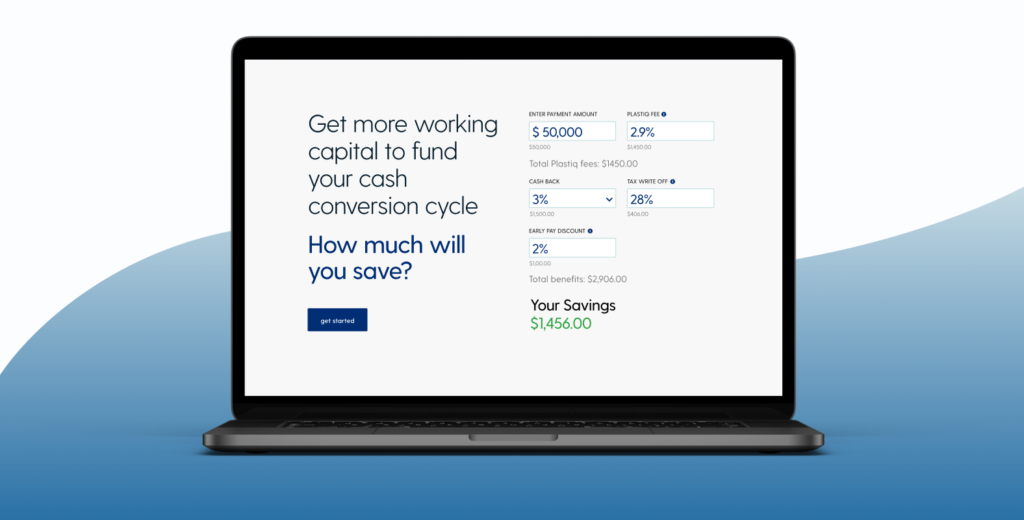

How much will my payment cost?

Plastiq charges a percentage fee on top of the total payment, in part to offset transaction fees incurred in the process of making the payment. However, Plastiq negotiates industry-low rates for the service which are then passed on to you, allowing you to make your mortgage payments with confidence. Learn more about Plastiq’s fee here.

How to use Plastiq to pay your mortgage with a credit card

Plastiq is the only payment service that allows you to pay your mortgage with a credit card. The process is convenient & straightforward, and most cardholders are accepted (including Discover, & Mastercard). Pay your mortgage on a one-time basis or schedule a recurring monthly payment – the choice is yours.

To make a payment, simply select your recipient, enter the principal amount, and choose the delivery date. If the payment is recurring, a dropdown will allow you to select the frequency of the payments as well as the end date, giving you full control of your funds.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.