Ten Thousand

Big goals and big growth mean a big need for the ability to use credit and float payments.

2 min. read

A strong start.

When men’s athletic company Ten Thousand launched in October of 2015, they hit the jackpot–a feature in GQ Magazine and an instant spike in sales. But then reality hit. “We didn’t really realize how good our launch actually was and how much harder it would be to keep that momentum going,” said Eugenio Labadie, CEO. “From there it was a bit of a slog of not having the working capital to stay in stock.”

Staying active with global payments.

As luck would have it, Ten Thousand’s credit issuer–Brex–turned them on to Plastiq. Now they had a way to maximize their credit and pay virtually anyone using their card. Labadie found it especially helpful as they dealt with global suppliers and factories spread across the world. “Plastiq allowed us to access these lines of credit for paying our overseas vendors which has been huge for allowing us to grow efficiently.”

Keeping inventory bulked up.

The access to credit came in especially handy for a company that needed to keep a close eye on inventory. As sales of their clothes in sport-specific categories like Brazilian jiu-jitsu increased, Ten Thousand needed the capital to keep product coming in ahead of the curve. “It’s really difficult for a brand that carries its own inventory to grow because of the amount of inventory we need to hold.” Using Brex and Plastiq helped them cover fluctuating costs and spread them out over a longer timeframe.

It’s working out.

As Ten Thousand continues to grow, Plastiq continues to be there for them. “Plastiq let us grow by allowing us to tap alternative sources of funding to pay vendors we otherwise wouldn’t have been able to pay.”

Without Plastiq, and these newly available credit sources,

we wouldn’t have been able to pay our oversea vendors.

JEugenio Labadie, CEO,

Ten Thousand

Getting in sync.

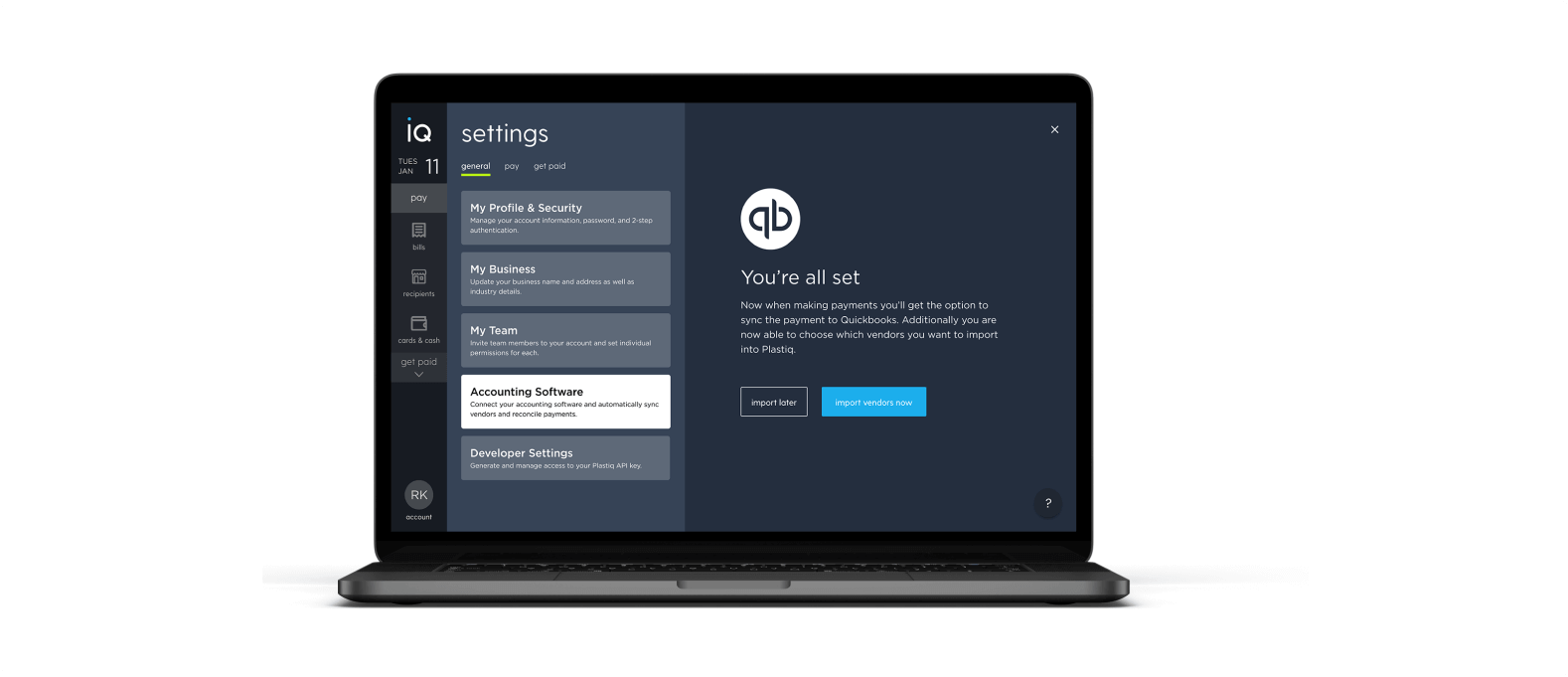

Ten Thousand is also looking forward to one of Plastiq’s newest features–Quickbooks Online integration. Syncing the two financial platforms will save the company precious time and money when it comes to billing and reconciling. “The new Quickbooks’ integration automatically does the splitting between the fee and the underlying payment,” said Eugenio. “That makes it so much easier to match them to our open bills within Quickbooks.”

Want to see your business grow like Ten Thousand?

Sign up with Plastiq for free.