BLOG

Plastiq Is A Critical Cash Flow Tool

3 min. read

Nov 5, 2020

I’ve been doing a lot of speaking—virtually of course—to industry groups made up of small- and medium-sized business owners over the past few months. And I’ve got a lot more scheduled throughout the next 12 months. Everyone wants to know about cash flow. Everyone wants advice. Can you blame them? The economy is in a recession and my clients with the most cash are the ones most likely to survive.

So that’s what I’m doing. As a certified public accountant, that’s what I’ve been trained to do. I talk to these business owners and managers about the importance of conserving cash and making sure they have at least six months available. I discuss the best ways to forecast cash flow. I offer advice on improving receivables collections and I discuss the key metrics and numbers everyone should be looking at frequently to keep their fingers on the pulse of their business.

I also talk about technologies that improve cash flow. Over the years, it’s been a lot of the same: cloud based accounting systems, automatic reports, alerts, budgeting tools, etc. But just this past year I’ve become familiar with a relatively new technology platform that I’ve been recommending: it’s called Plastiq.

What’s so special about this platform? In short, Plastiq customers can use the service to pay for virtually anything with their credit card. It doesn’t matter if their vendors or suppliers don’t accept credit cards. Plastiq takes care of the payment by billing your card and then sending a check or transferring the money.

So why is using a credit card for all purchases so impactful on a company’s cash flow? There are many reasons.

For starters, many small businesses have limited financing through traditional means (banks) and rely on credit cards for their purchases. Of course the interest rates are high, but no interest is usually due if you pay the balance off currently. That means that you can play the float by buying stuff now and not paying for it for 30-45 days.

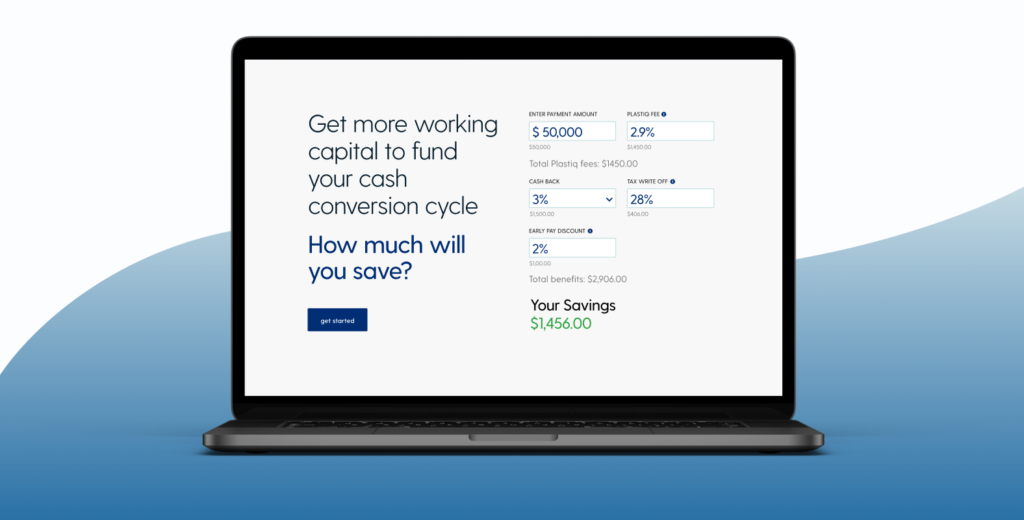

Credit card purchases save in other ways. By using a credit card line you can make bigger purchases from a vendor that offers volume discounts. You can more easily buy from international suppliers. And, depending on the card you have, your business can earn cash back, points or other benefits while offsetting the small Plastiq fee (which is the lowest among their competition).

All of this impacts cash flow. It improves cash flow management. It gives a business owner more flexibility and more control over cash. The limitation has been that many businesses don’t accept credit cards. But using Plastiq, that’s no longer a hurdle.

Due to this unprecedented economic downturn, cash management will continue to be a big topic for the foreseeable future. I’ll keep sharing my thoughts and giving advice. And I’ll continue to recommend Plastiq as a great tool to help businesses of all sizes better control their cash flow.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.