BLOG

Four Technologies That Four Technology Experts Say Will Increase Your Cash Flow

4 min. read

Oct 7, 2020

Maybe you saw the discussion I had with John Horner, Ivan Mehta and Tom Berdan. If you didn’t you should watch it here. You’ll pick up some great advice about a few new—and not so new—technologies you should be using in your business. Why? Because our discussion was about cash management and cash flow, and the technologies we discussed all have a big impact on how companies handle their money.

Although we covered a wide range of topics, each of our experts (and myself) had the opportunity to zero in on at least one great technology that impacts a company’s cash.

For example, Mehta—an India-based tech writer for The Next Web—talked about the rise of digital payments. In India, he explains, many small businesses have embraced payments through the country’s Universal Payment Interface (UPI) that allows payments directly from a mobile phone just by sending a message. It’s not unlike Venmo here in the U.S., but more widely accepted. “There are a lot more mobile devices in India so if I know your UPI address I can pay you from my phone,” he says. “You can have an address for your business.” The system links your phone number and your bank account together and Mehta says that the transaction fees are “just a few cents” to any shopkeeper.

Accepting mobile payments in the world’s biggest democracy will continue to catch on in this country and smart business owners will make sure they are keeping current on all the new popular ways to make payments so that they’re not turning customers away…and losing cash flow.

Berdan is the Chief Marketing Officer of Dade Systems and he wanted (with good reason) to highlight how his company positively impacts his customers’ cash management. Dade Systems is a middleman that uses scanning technology and artificial intelligence to take the manual work out of inputting checks received. They also provide more remittance information for ACH, wire transfer and credit card payments, all of which saves time and increases cash flow. “Our software replaces the human that processes those payments. We use AI to apply a payment properly and then send a posting file back to the ERP system maintained by the customer,” he says.

As businesses progress and grow, they add more people, which impacts cash flow. Accounts receivable automation technologies like the one that Dade Systems provides helps save time and reduce errors. That turns into lower costs and better cash flow management

Horner, a vice president at technology firm Miles Technologies, discussed how cloud and web based financial systems improve data entry and reporting, which in turn gives a business owner more control over cash flow management. “So many organizations are working with data that resides on their server accounting system,” he says. “As we know people are now working from home and they’ve learned what cloud and web technologies can do to bring people together.”

Horner believes that the credibility achieved by cloud and web systems during the recent pandemic will help fuel a rise in systems hosted in the cloud, and that will have a big impact on how people manage their cash. “These systems will be adopted more and more over the next few years,” he says.

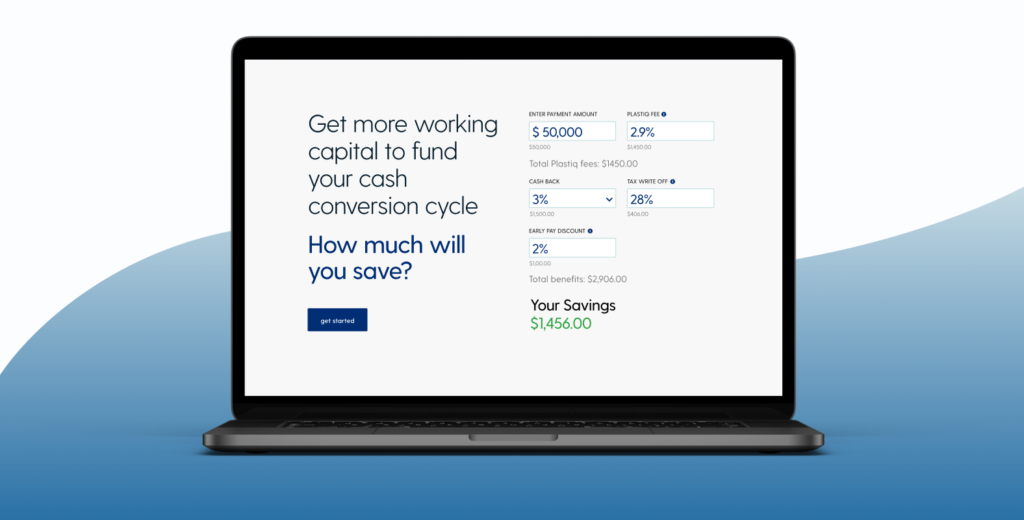

Finally, I couldn’t resist mentioning Plastiq. That’s because Plastiq is one of my favorite cash management tools. With it, you can use a credit card for virtually any purchase from any supplier, regardless of whether or not they accept credit cards. I gain more cash flow by leveraging my credit card’s monthly float, earn credit card reward points, gain flexibility to make larger payments, and save on fees that banks charge for international transactions. Plastiq charges my card, then takes care of the payment via check, ACH or wire. It’s a simple concept with far-reaching implications for any business owner looking to manage their cash better.

These are just a few of the highlights. We got into other forms of payment, the renewed romance of QR Codes and some ways to speed up invoice processing among other tactics for improving a company’s cash flow. In the end, we know it’s all about cash. Those businesses with the best control over their money are the ones who are better positioned to grow in the years ahead.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.