BLOG

Are Amazon Loans Worth It?

2 min. read

Nov 1, 2019

Selling products on Amazon is a great way to make a seven-figure income (or more).¬† But many sellers need capital to grow their business. If you’re one of the lucky few that are invited, Amazon offers their ‚ÄúAmazon Loans‚Äù product.¬† But is it worth it?

Summary:

Amazon offers their sellers loans based on their sales to help them buy more inventory.¬† It’s a ‚Äúby invitation only‚Äù program that can offer up to $750,000 in instant funding.

Qualifications:

If you qualify, Amazon will invite you to take out a loan.  This is much different than what most business owners are used to, by requesting loans through lending institutions.  Since Amazon does not publicize the program, information about how to qualify is scarce. Some data points point to length of time selling among one qualification.

However, Amazon factors volume and velocity of sales as a part of extending an invitation.

Costs:

Amazon does not advertise its lending rates.  However, Amazon Sellers have posted various data points online showing the interest rate around 15%, placing Amazon Loans in the same competitive space as business credit cards.

Terms are fixed for this loan and presented to the user.  Payments are taken out directly from your Amazon Sellers account.

How Amazon Loans Differ from Plastiq:

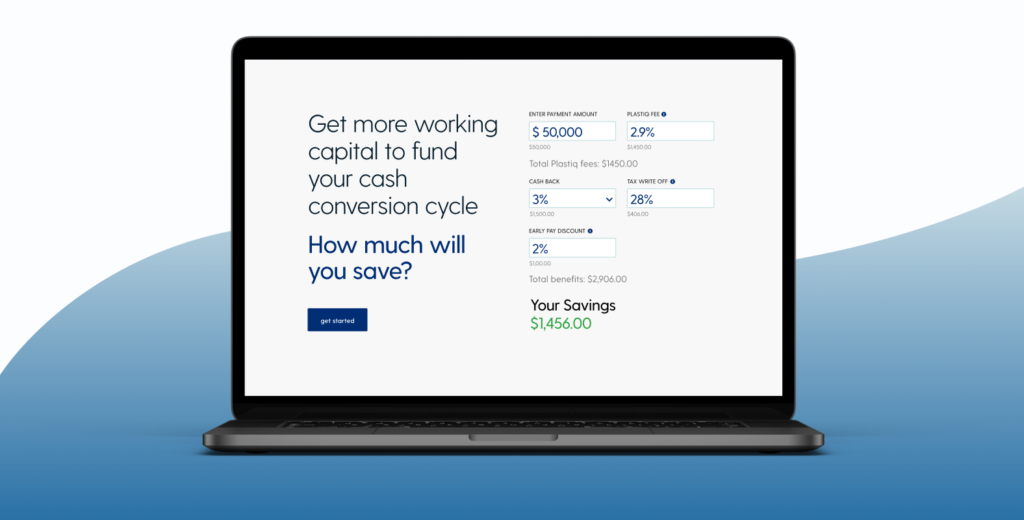

Plastiq is the bill pay service that helps you keep more cash on hand.¬† Plastiq is not a loan nor a line of credit. Unlike Amazon Loans, Plastiq lets you unlock your existing credit by letting you pay your vendors and suppliers with a credit card.¬† Even when cards aren’t accepted.

Using Plastiq is simple. Sign up for a free account at Plastiq.com and add in your favorite cards. Then set up payments for your vendors and suppliers, just like you would through any other payment service.

Ecommerce sellers who use Plastiq to pay their suppliers enjoy up to 60 days of cash float, improved cash flow, and keep more cash on hand so they can go after new business opportunities.  And they earn points and miles through card rewards just for making business payments.

Why take out another loan when Plastiq can help you better utilize the credit already in your wallet?  Thousands of businesses have discovered the Plastiq advantage. Get started today!

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.