BLOG

Is a Business Line of Credit Right for Your Company?

3 min. read

Apr 2, 2018

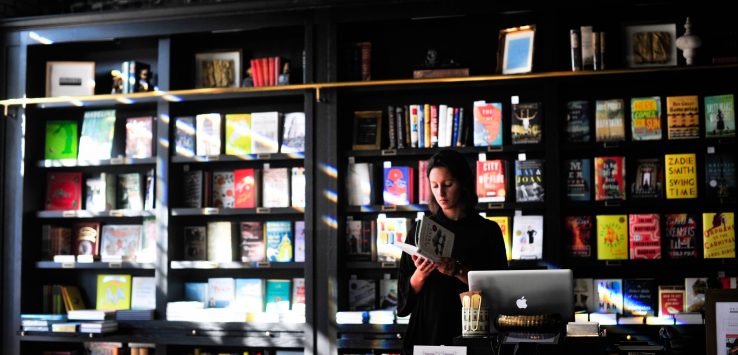

In business since 1998, Paige NeJame knows that a healthy company has access to working capital. That’s why several years ago she obtained a credit line.

“I have an SBA-backed credit line that’s been integral to the expansion of my business,” says NeJame, owner of the CertaPro Painters of the South Shore & Boston franchise. “I use the credit line to fund large commercial painting projects.”

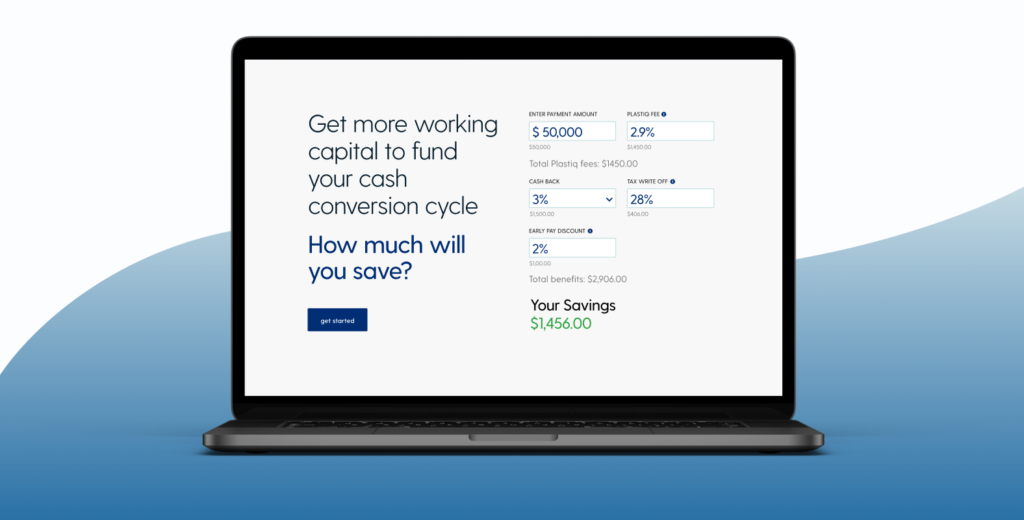

If you want to take your business to the next level, you probably require additional working capital. A small business line of credit is one option for securing funding.

What is a Small Business Line of Credit?

A business line of credit is a loan from a financial institution in the form of a specific amount of credit. Unlike other forms of credit, like auto loans, you can use credit line funds for whatever you choose.

On a small business line of credit, you only pay interest on the credit you tap. For instance, if you’re granted a new business line of credit for $25,000 and you use $1,500 for business signage, you only pay interest on $1,500.

A secured business line of credit requires that you guarantee the credit line with collateral, such as a piece of property. If you’re unable to repay the credit line as required, the financial institution can seize your property in lieu of payment.

An unsecured business line of credit requires no collateral. Unsecured business lines of credit are more difficult to obtain than secured ones. Carefully consider which type of account would be the best business line of credit for your company.

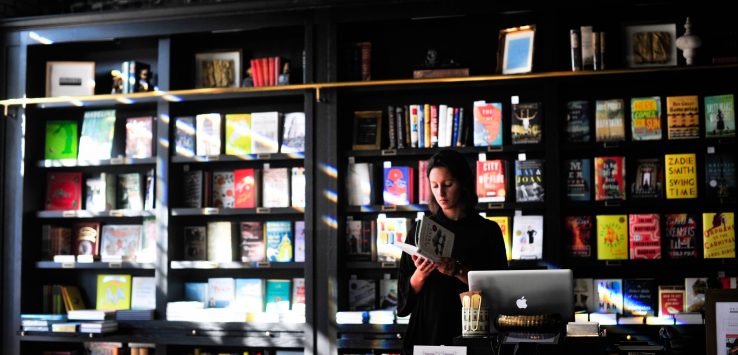

Small Business Line of Credit Pros

A credit line works like a credit card, offering you fast, easy access to cash. You can tap into the money on your credit line whenever you want and control how much you borrow.

You pay no interest on a business line of credit until you borrow. That means you can set up a business line of credit just in case you need it for an emergency.

Make on-time payments to a credit line, and your credit score will improve.

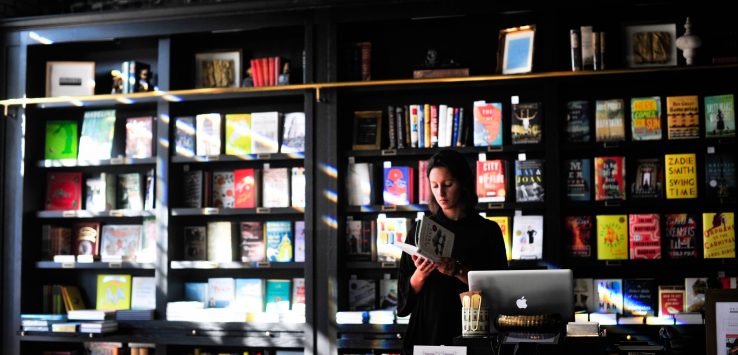

Business Line of Credit Cons

Most business lines of credit have setup fees, and there may be annual fees. You’ll also pay interest. If you don’t pay as agreed and the credit line is a secured one, you risk losing the property you put up as collateral.

Some financial institutions don’t grant credit lines until your business is at least two years old and showing a profit. You also need a strong credit history.

If your company requires a significant amount of money for a purchase, like machinery, you may find a small business loan is a better option. Check small business loan rates and compare the two options.

Securing a business line of credit can help you grow your business. Terms and rates for business credit lines vary. Check out all of your options before deciding if a business credit line is right for your company.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.