Accelerate your business.

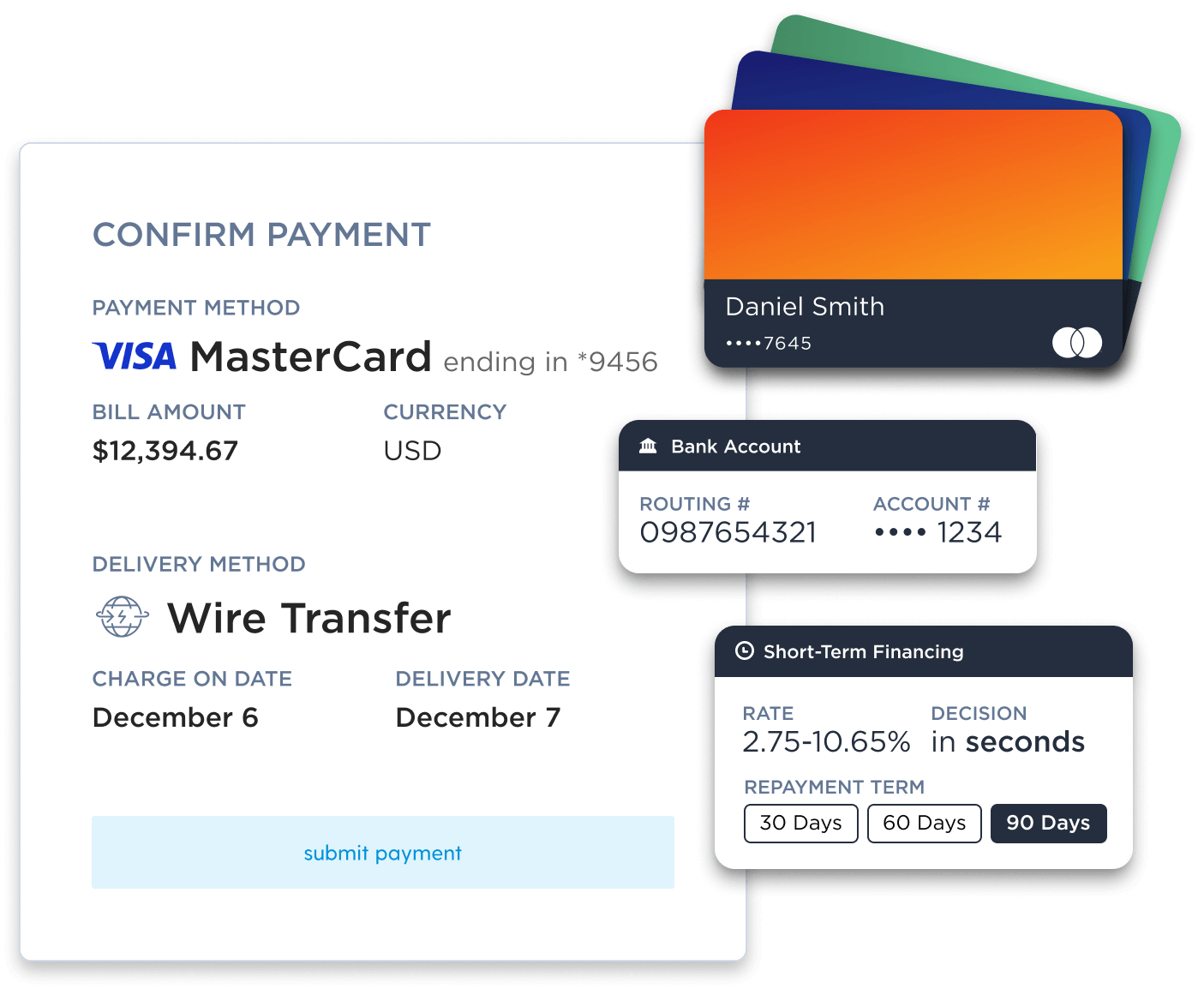

Take advantage of credit cards and short-term financing to drive your business growth.

Save time and money with streamlined payment processing.

The PLASTIQ PRODUCT SUITE

Fast, flexible financial control.

Seamlessly manage your cashflow. Shift your business to a higher gear.

Tap into credit cards and short-term financing to control your business.

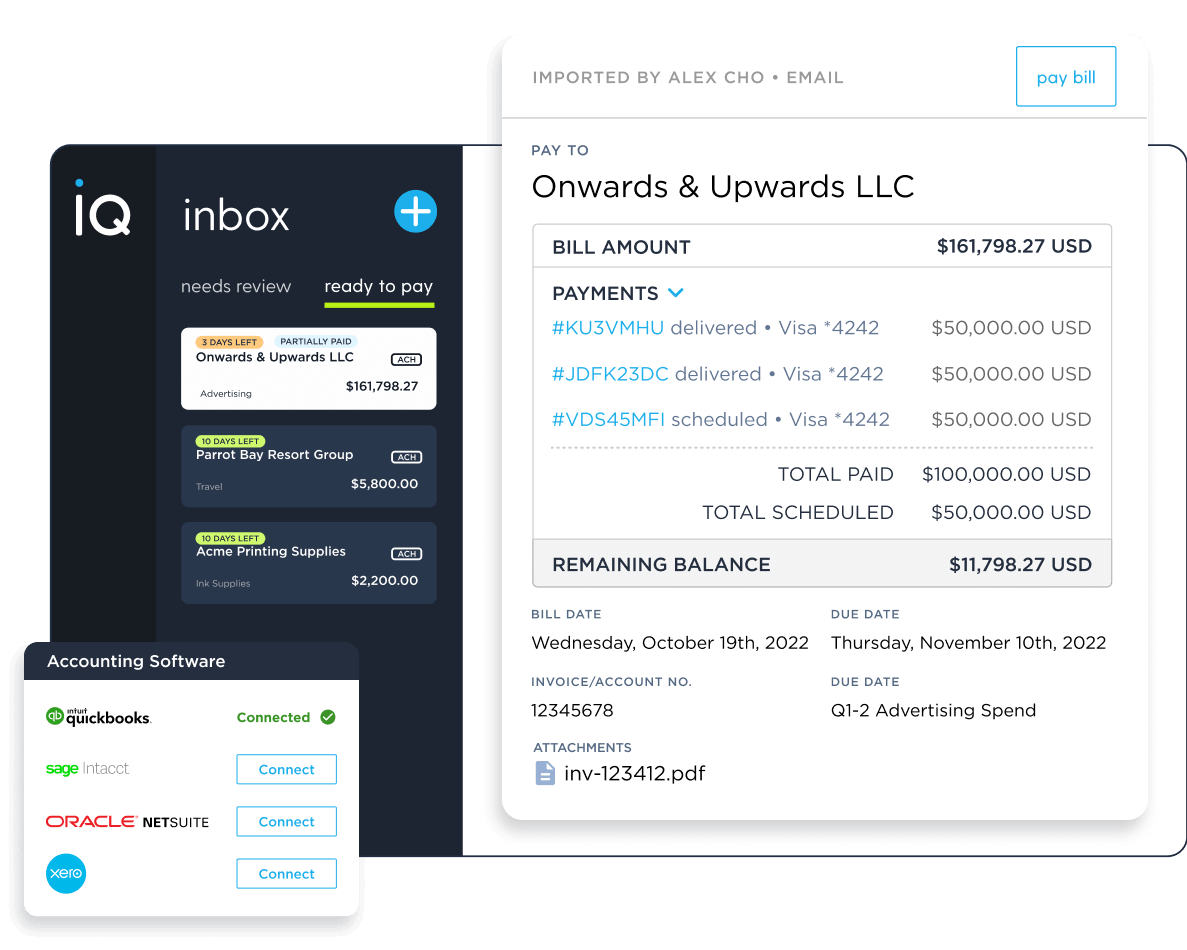

Keep organized with effortless Accounts Payable sync and workflows.

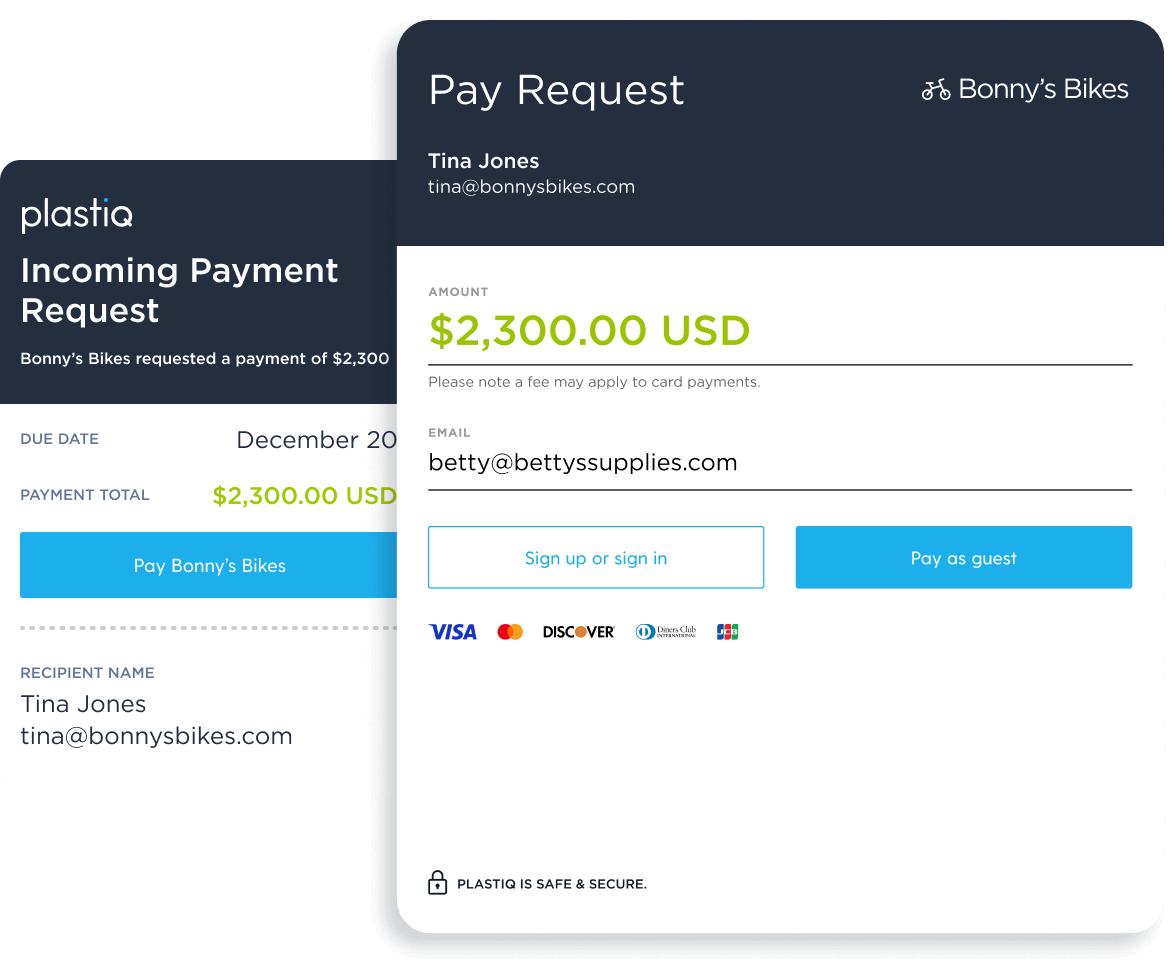

Fast, zero merchant fee payments. Strong client relationships.

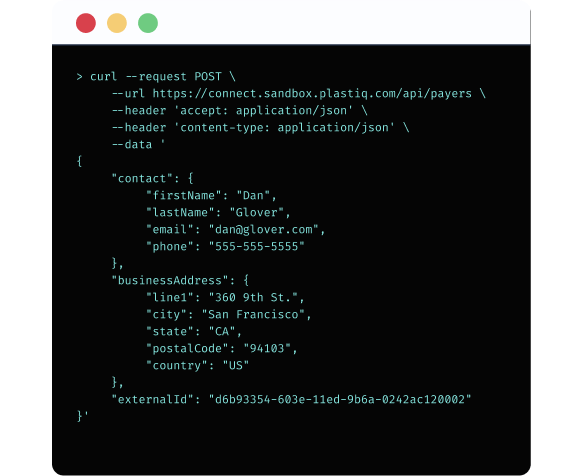

Embedded payments to better serve customers and capture revenue.

What our clients are saying

"With Plastiq, I don't have to pay my Facebook advertising bill for January until April, freeing up cash flow and making my business run smoother."

Jason Rappaport, CEO

"Plastiq makes it so you don't have to worry about expenses until you've already made the sale."

Ronak Shah, Founder & CEO, Obvi, Consultant

“We’re using Plastiq for all payments that fall outside the weekly bill run. It’s a multi-faceted tool. I’m discovering new ways to leverage it. For me, Plastiq solves a lot of problems all at once.”

Todd Smith, VP Corporate Controller, Sunbasket

How it Works

Leverage credit cards and capture the benefits.

Plastiq lets buyers pay on their terms and vendors receive payment on their terms, while providing everyone access to the benefits of credit.

Speed up profit.

Use credit payments to delay cash outflow, extend Days Payable and lower the Cash Conversion Cycle.

Lower cost of capital.

2.9% credit card fees beat the rates of most SMB loans, extending float 60-90 extra days.

Shift fees upstream.

Zero fees on AR maintains margins, while fees for AP are tax deductible* to increase your bottom line.

* Plastiq does not provide tax advice. Please consult a tax expert for applicability.

Security, Risk & Compliance

Protect your business with best-in-class security.

PCI & DSS Level 1 certified since 2015

Bank-grade security, military-grade encryption

Industry-best risk analysis for business protection

100% data privacy & tokenization for financial security

SOC 2 Type II Compliant & Certified